Replacement Checks: 3 Basic Questions

Despite the seemingly popular usage of bank checks, there are still a number of depositors who are not familiar with replacement checks. Basically, these are also referred to as substitute checks or Image Replacement Document (IRD), which are negotiable instruments corresponding to digital reproductions of original paper bank checks. This means that it is covered by the Check Clearing law under the 21st Century Act or Check 21 Act. The intention for the usage of these types of negotiable instruments is to facilitate the transfer and movement of funds.

The use of these negotiable instruments also takes the place of having to present the paper bank checks to conventional financial institutions for the processing of payments based on the written order of the checking account holder. The replacement checks are subjected to payment processing via electronic centers that submit the information received by the issuing bank and passed for settlement to the Federal Reserve System. In order to have a better understanding of these negotiable instruments, consider the following questions.

1. Are these types of bank checks legally recognized?

The replacement checks are legally recognized within the United States provided that they meet certain requirements. The most basic of these requirements is that it must be a faithful reproduction of the original paper bank check. Any discrepancy between the two negotiable instruments can invalidate the transaction completely. It must also be covered by a warranty from the reconverting conventional financial institutions responsible for generating it.

It is equally important that these types of bank checks include both the front and back portions of the original paper bank check. It must also have the MICR (Magnetic Ink Character Recognition) line, which contains all of the data from the original to help facilitate its processing. These negotiable instruments must also conform to the dimensions and paper stock of the industry standards. It is vital that they can be suitably subjected to automated processing much line the original paper bank checks.

2. What is the clearing process?

The EPC (External Processing Code) associated with the processing of these types of bank checks forwarded for collection should have the value “4” in the 44th position of the MICR line. The original paper bank check must be endorsed by the payee as it is presented to the depository bank. It is then stamped for endorsement at the back portion of the bank check. After this process, the bank will capture the image of both the front and back portions of the original paper bank check including the MICR line data.

The original bank check is then truncated from the clearing process and uses the created image, electronic endorsement, and MICR line data. The electronic endorsement subsequently generates the replacement checks, which will be transmitted electronically to the payee bank to facilitate the settlement of the amount. In instances where there is no agreement among processing banks, the original bank check or its legal equivalent must be presented by the requesting conventional financial institution.

Normally, the payee bank will use the image along with the MICR line data to process the clearing of the bank check similar to the course of settlement used for paper bank checks. When the settlement process is completed, a copy is provided to the checking account holder usually through the periodic statement delivered by the issuing financial institution. All conventional financial institutions involved in forward collection can be considered as reconverting banks.

3. What are the legal requirements?

As earlier stated, these types of negotiable instruments are legally recognized within the United States. This is as long as they conform to the legal requirements that are based primarily on accurateness of the reproduction. This means that all information reflected on these bank checks should have the name of the payor, name of the payee, courtesy as well as legal amounts, encoding information, endorsements, and other pertinent details, as they appear on the original paper bank checks.

The importance of the MICR line data accuracy must be severely emphasized to ensure the validity of the bank checks. It is also of primary importance that the replacement checks carry the words “This is a legal copy of your check. You can use it the same way you would use the original check.” The conventional financial institution processing the bank checks delivers the warranty as they remove the original paper bank checks from the forward collection process and use the electronic reproduction of the original instead.

Conventional financial institutions must be fully aware that they should adhere to the ASC X9 standards during the removal of the original check as well as while they capture the bank check images including the MICR line data. Checking account holders should be aware that any images, image statements, photocopies, or checks posted online are not legally recognized by the banking system as the equivalents of the original paper bank checks.

The main reason is that these will never be accepted for bank check clearing procedures during the settlement because they fail to strictly comply with the guidelines for the use of electronic reproductions as specified by the Check 21 Act. Therefore, in order to preserve the legality of these negotiable instruments, it is important that they are subjected to the existing guidelines based on the specifications of banking laws and regulations.

Checking account holders must be fully aware that there are other laws and regulations in the United States that cover the use of these types of negotiable instruments like the Expedited Funds Availability Act for example. There are also some State and Federal regulatory laws that must be considered along with pertinent provisions of the UCC (Uniform Commercial Code) as it relates to bank deposits including collections.

The Federal laws undoubtedly would include regulations issued by the Federal Reserve, especially as it relates to duplicate payments and fraud arising from the settlement of bank checks. It is equally important to point out that State and Federal laws including UCC provisions that may conflict with the Check 21 Act will be overridden by the latter based on potential inconsistencies. All of these eventually form the legal requirements for these types of bank checks.

It is easy to see that the use of replacement checks can be quite confusing, but by understanding these basic questions, checking account holders will be able to take advantage of its benefits.

|

Why should someone’s design determine who you are as a person? It shouldn’t – that’s why Carousel Checks offers you the opportunity to design your own discounted checks free of customization charges. |

Custom Photo Check

We are different then other photo check providers. One of our photo professionals looks at every image, and makes it the best possible photo check for you. You can have as many images rotating in your order of checks there is no limit (rotating means each image is a different image, then starting over at the beginning of the images). |

Photo Checks

Bring your cherished photos to life with Photo Checks. This is your chance to display your precious children, beloved pets, classic car, or any other cherished memory on your checks. Select your check format and quantity to begin creating your own photo checks today! |

| Photo Checks – Rotating

Bring your cherished photos to life with Photo Checks. This is your chance to display your precious children, beloved pets, classic car, or any other cherished memory on your checks. Select your check format and quantity to begin creating your own photo checks today! |

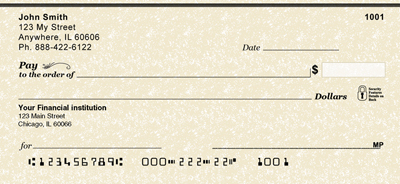

Antique

Do you watch the Antique Roadshow? If so these checks are just for you! Classic and stylish. |

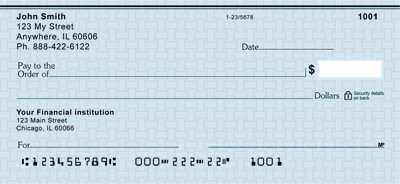

Modern Suave

Blue chill: simple, elegant, and modern. We’ve got plenty more options with a similar style and more colors. |