4 Benefits Delivered By Personal Bank Checks

There is no disputing that personal bank checks have been regarded for quite some time now as one of the most popular ways to pay for purchases and other financial obligations like bills and mortgages for example. It does not matter if the transactions are point-of-sales or third party payments; there is a degree of preference for the use of this type of bank checks. Because of its popularity, almost every American has a personal checking account.

Essentially, personal bank checks are drawn from the personal funds of account holders or bank depositors. Every time that the checking account holder uses the bank checks for their transactions, it is their responsibility to ensure that there will be sufficient funds in the bank account to cover the order of payment written on the bank checks, otherwise, checking account holders will face penalties and fees for insufficiency of funds. Let us look at some of the benefits that can be received from this type of bank checks.

1. Convenience

When dealing with bank checks, convenience can actually refer to a number of things like being accepted not only by various business establishments, but persons as well. This is more convenient compared to what can be delivered by credit cards for example, because although credit cards are acceptable forms of payments for business establishments, they cannot be used to settle financial obligations with individuals.

The benefit of convenience can also relate to the protection that personal bank checks can provide for checking account holders. Essentially, because bank checks eliminate the need to carry cash, the checking account holders minimize the possibility of theft against them. The bank checks can also be used as receipts of transactions once they are processed by the banks and mailed back to the checking account holders.

Since bank checks are negotiable instruments, they can only be issued by bank depositors who have a personal checking account. Bank checks also represent the written order of the depositor to the bank holding the account to make the funds available to the physical bearer of bank checks. The bank checks can also be deposited by recipients directly to their own bank accounts.

2. Enhanced security features

Compared to money, personal bank checks are considered more secure because they are issued to a specific person or group. Aside from this, there are also built-in security features placed in bank checks to protect them from counterfeit like tampering with the amount or signature. There are also some online check printing services that offer bank checks with enhanced security features to ensure that the finances of checking account holders are protected. Some of the security features that are commonly used are:

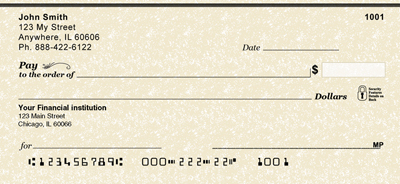

• The Lock symbol – this is normally found at the front of bank checks to inform checking account holders that there are security features embedded. The lock symbol can also be found at the back portion of bank checks together with the explanation of check fraud protection features that have been placed on the face of bank checks. The Check Payment Systems Association (CPSA) holds the trademark for this icon. This icon means that there are at least three security features included in the bank checks based on the CPSA guidelines.

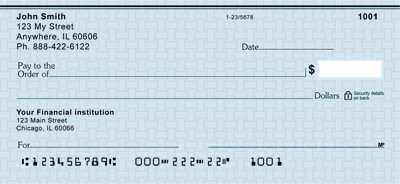

• Microprinting Technology – the presence of this fraud protection function is indicated by the letters “MP” placed at the right side of the signature line. The technology incorporates an extra fine print that can only be read with magnification. Due to the extremely small size of the print, it is extremely difficult to photocopy or reproduce. It is therefore an efficient deterrent to attempts to counterfeit bank checks.

• Specialty Paper – these types of paper contain security features that are built-in during the manufacture process. They are based on the American National Standards Institute (ANSI) guidelines that are meant to ensure that security features remain uniform for all bank checks. The paper is usually treated with chemicals that will make it change color the moment an alteration is attempted. This makes it more difficult to counterfeit bank checks through reproduction.

• Specialty Ink – bank checks make use of Magnetic Ink Character Recognition (MICR), which requires magnetic ink. This is different from the type of ink normally used by conventional printing equipment. The ink is used for the bank code lines and is characterized by their dull appearance. Usually, counterfeit bank checks have a shiny ink for the bank code lines, which makes it easier to spot a fake.

3. Minimal to no fees

Many personal checking accounts do not have monthly maintenance fees, service charges, check usage fees, and payments for paper statements. This means that checking account holders can actually save substantial amounts of money. There are also some checking accounts that do not require a minimum balance, which means no penalties are levied when the deposited amount takes a dip.

Checking account holders however need to be aware of the practice of some banks to impose hidden fees. This can normally be in the form of debit card usage or using the ATM of another bank. Despite of this, this type of bank checks actually allow checking account holders to earn substantial interest on their money based on the balance of the checking account. This means that the higher the balance available, the higher the interest rate to be earned.

To maximize the benefits of this type of bank checks, look for checking accounts that do not impose hidden charges for ATM and debit card usage. This will ensure that the money in the checking account will continue to grow and reap dividends for checking account holders.

4. Checking account overdraft protection

In the banking system, the overdraft protection feature is considered as a type of line of credit that helps to protect checking account holders in instances where they spend more than what is available in their checking account. It is important to note though that the overdraft protection feature may vary among different banks. This means that checking account holders need to familiarize themselves with the details to ensure that they properly get the benefits for their personal bank checks.

These are four benefits of personal bank checks that checking account holders can take advantage of.

|

Why should someone’s design determine who you are as a person? It shouldn’t – that’s why Carousel Checks offers you the opportunity to design your own discounted checks free of customization charges. |

Custom Photo Check

We are different then other photo check providers. One of our photo professionals looks at every image, and makes it the best possible photo check for you. You can have as many images rotating in your order of checks there is no limit (rotating means each image is a different image, then starting over at the beginning of the images). |

Photo Checks

Bring your cherished photos to life with Photo Checks. This is your chance to display your precious children, beloved pets, classic car, or any other cherished memory on your checks. Select your check format and quantity to begin creating your own photo checks today! |

| Photo Checks – Rotating

Bring your cherished photos to life with Photo Checks. This is your chance to display your precious children, beloved pets, classic car, or any other cherished memory on your checks. Select your check format and quantity to begin creating your own photo checks today! |

Antique

Do you watch the Antique Roadshow? If so these checks are just for you! Classic and stylish. |

Modern Suave

Blue chill: simple, elegant, and modern. We’ve got plenty more options with a similar style and more colors. |