Why Bank Routing Numbers Are Important

Dating back several centuries ago, to the Roman civilization, bank checks have a very long history of being employed as currency. At first, many merchants and consumers were very skeptical at the idea of handing over their hard earned money to strangers, in return for a slip of paper. However, over time bank check continued to grow in popularity and began to play a vital role in money transactions. As businesses flourished and travel became faster and easier, merchants realized that they needed a way to keep track of bank checks. The system that was created, using numbers or digits on bank checks, can be traced back to a British banker by the name of Lawrence Childs in 1762. Lawrence is believed to be the first banker to keep track of bank checks using serial numbers.

The word “check” originated in England as well; due to the fact that the serial numbers were used to keep a “check” on the fiscal papers. In 1910, serial numbers ceased to keep bank checks organized and accounted for in the growing banking industry. As a solution to this pressing problem, ABA numbers were introduced by the American Bankers Association; every traditional banking institution was assigned a unique ABA institution identifier. A common term for ABA numbers today is RTN or Routing Transit Numbers.

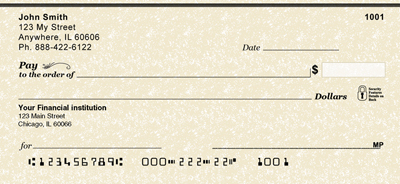

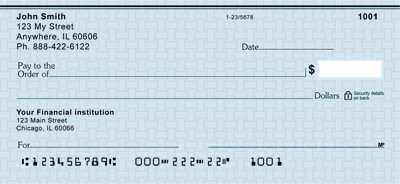

Bank routing numbers are located on every deposit slip and bank check. The nine digit code is printed in the lower left section of the bank check and is the bank routing number used by traditional banking institutions to identify the bank that the bank check originated from. The nine digit code is not just a sequential number given to each bank check as it is printed, but every digit in the bank routing number has a specific purpose.

• The first four numbers are designated by the Federal Reserve Routing System and symbolize the bank’s location. As time has gone on and traditional banking institutions have continued to expand and merge, however, the actually physical location of the bank branch is not as accurate today as it was when bank routing numbers were first created.

• The fifth and sixth number represent which of the twelve federal reserve banks the wire and electronic transfer will be routed to. By knowing which federal reserve bank is being used, banks are better able to figure out which account the money is being sent from.

• The seventh number designates which processing center is assigned to the traditional banking institution. The bank check processing center is where the bank check goes to get cleared before the transfer can be put into effect.

• The eight number denotes the district in which the traditional banking institution is located.

• Lastly, the ninth number provides a mathematical expression of the first eight digits. By giving bank checks mathematical codes, traditional banking institutions are able to help prevent bank check forgery and fraud. Privacy and security for checking account holders is vitally important for a bank’s customer service; problems such as fraud can be a huge problem for a checking account holder’s financial life, credit score, and bank standing.

There are many common uses for bank routing numbers on bank checks, other than institutional purposes, such as setting up a direct deposit of income tax refunds, arranging for direct deposit of payroll checks, organizing automatic bill payments, and making wire transfers. Often times, employers will ask for a canceled bank check with the bank routing number and checking account number you wish to deposit your payroll checks into. This limits the amount of errors that may result from any one of the bank routing numbers being incorrect. If these errors occur, a checking account holder’s paycheck may be accidentally deposited into the wrong customers bank account.

Though many checking account holders understand why the nine digit bank routing number is important, they often have a hard time finding where the code is located and which set of digits the bank routing number is on their bank checks. The bank’s routing transit number is always the first nine numbers in the bottom left of the bank check. Be careful not to confuse the nine digit bank routing number with the bank check number, which is located just to the right of the bank routing number. Also, when looking for the bank routing number, ignore the two colons and horizontal dash; only the numbers in between these symbols are a part of the bank routing number.

What began centuries ago and, over the years, spread from culture to culture, has now become a huge influence on the way we run traditional banking institutions today. Bank Routing numbers not only show the physical location of the bank, which Federal Reserve Bank the wire transfer will route to, which processing center the check will be sent to, and which district the traditional banking institution is located in; but also, bank routing numbers work to protect the check writer from fraud and accidental deposits. Accidents could cost checking account holders heaps of money and require a lot of time to sort the problem out with the bank. These, seemingly unimportant, nine digit numbers are hugely beneficial in keeping checking account holders fiscal lives running smoothly, and it is crucial we appreciate their significance in order to a understand how to use bank routing numbers to our best advantage.

|

Why should someone’s design determine who you are as a person? It shouldn’t – that’s why Carousel Checks offers you the opportunity to design your own discounted checks free of customization charges. |

Custom Photo Check

We are different then other photo check providers. One of our photo professionals looks at every image, and makes it the best possible photo check for you. You can have as many images rotating in your order of checks there is no limit (rotating means each image is a different image, then starting over at the beginning of the images). |

Photo Checks

Bring your cherished photos to life with Photo Checks. This is your chance to display your precious children, beloved pets, classic car, or any other cherished memory on your checks. Select your check format and quantity to begin creating your own photo checks today! |

| Photo Checks – Rotating

Bring your cherished photos to life with Photo Checks. This is your chance to display your precious children, beloved pets, classic car, or any other cherished memory on your checks. Select your check format and quantity to begin creating your own photo checks today! |

Antique

Do you watch the Antique Roadshow? If so these checks are just for you! Classic and stylish. |

Modern Suave

Blue chill: simple, elegant, and modern. We’ve got plenty more options with a similar style and more colors. |